Flood insurance – growing risks, subsidized premiums

Less than 1 in 5 homeowners in a flood zone have it.

And it’s a bargain.

FEMA revised America’s flood maps recently, dramatically expanding the 100-year flood plain. In New York state, they doubled the number of homes in the danger zone. If climate change operates as predicted, they may expand it again in a few years.

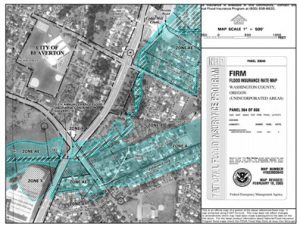

The risk to your family’s home’s is easy to check. Just go to the FEMA map center and choose your location. Colors and codes indicate the various areas of flood risk, from none to huge.

The risk to your family’s home’s is easy to check. Just go to the FEMA map center and choose your location. Colors and codes indicate the various areas of flood risk, from none to huge.

Want to look further into the future? There’s an attempt using Google Maps to show flooding at various levels of storm surge or sea level rise. The data are not very accurate, for several reasons, but they will give you an idea where you might not want to own property during the predicted hurricane-driven high tides of the coming decade.

Want to see what major American cities look like after a one-meter rise in sea-level? There are some sobering simulations. And if you worry about truly catastrophic sea level rise in the future, there are maps that show which, if any, of America’s coastal regions will remain after such an inundation.

Flood insurance could limit your family’s risks far more effectively than sandbags or sump pumps. Your homeowners policy says, “. . . does not cover damage resulting from flood,” but insurance is offered by the National Flood Insurance Program. In fact most mortgage lenders require this coverage if the property lies in a flood zone.

Policies have been so cheap that Congress last summer raised the rates considerably. But cost still may be increasing more slowly than risk. And you don’t pay the full cost anyway. It’s subsidized by Federal taxpayers.

(And while you’re thinking of protecting you property from weather-related risks, consider protecting your investment portfolio too.)