Warming and stagflation

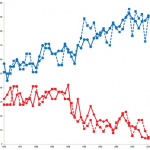

Warming brings both recession and inflation,

blunting one of our defensive weapons.

A new report from Schroders asset managers tells us that warming will depress economic growth thanks to “damage to property and infrastructure, lost productivity, mass migration and security threats.” We already know that.

At the same time warming is pushing up prices, thanks to reduced crop yields, the need to trash and rebuild hundreds of shoreside energy plants, jumping insurance premiums for businesses and homeowners, and many other costs. Schroders says, “from this perspective, the costs of climate change are already affecting global activity.” We know that too.

But put the stagnation and the inflation projections together, and we notice something not talked about: one of our policy levers – monetary policy (not very effective these days anyway) will become less and less useful. Schroders tells us, “From a monetary policy standpoint, such a stagflationary environment will place the world’s central banks in a dilemma: weaker growth will bring calls to stimulate the economy, but such efforts are only likely to aggravate inflation.”

Thank goodness we still have fiscal policy. We can count on Congress to stimulate the economy, right?