Millions of fiscal crises

A friend’s question.

A generation’s dilemma.

“Know any good investment books she should read?” my friend asked. “My mother’s mid-fifties and is just thinking about where the money’s coming from for retirement. She’s got about $15,000 saved.”

Heading towards a retirement in poverty, this woman is not alone. Three quarters of near retirees (ages 50 to 64) with incomes below $52,000 had an average IRA or 401k balance of $26,000. Even those with higher incomes have saved only $100,000 on average. And Social Security benefits, currently averaging $1,230/mo, are shrinking.

Heading towards a retirement in poverty, this woman is not alone. Three quarters of near retirees (ages 50 to 64) with incomes below $52,000 had an average IRA or 401k balance of $26,000. Even those with higher incomes have saved only $100,000 on average. And Social Security benefits, currently averaging $1,230/mo, are shrinking.

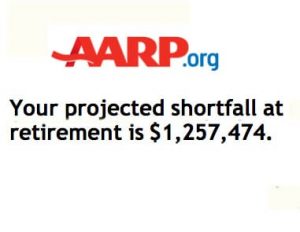

How much do today’s retirees need? The AARP calculator suggests she needs savings of over 20 times her annual retirement expenses to make it through an old age that medical science is constantly lengthening. That’s over half a million dollars to have a good chance at $25,000 a year!

Yes, some near-retirees have other savings: equity in their homes, a spouse with similar savings, maybe a legacy coming, or children who can support them. But, even including these, most have nowhere near enough savings for their senior years.

If the near-retirees in your life might be in this category, seems like an investment book’s not their first need. Better start by helping them use one of the many retirement-planning calculators, like AARP’s. This could show the whole family a potentially impoverished retirement. And what spending and saving levels – perhaps dramatically changed – are needed to avoid it.

I’ll explore some catch-up strategies in coming articles.