Your fall from the Fiscal Cliff – what impact?

There are calculators.

But they don’t tell the half of it.

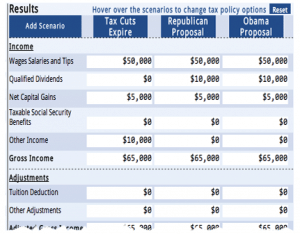

How much more will you pay in taxes after Congress does something (or nothing) about the Fiscal Cliff?

You can calculate your federal income taxes under three different Fiscal Cliff scenarios on the Tax Foundation’s web site.

There are other calculators out there too, like the simpler one at creditcard.com. It assumes that Congress does nothing and we go off the cliff. The Tax Policy Center offers a more complex one.

But they don’t even glance at the other inevitable impacts on your family’s finances. If taxes go up, consumers will spend less – perhaps enough less to trigger a recession. Another recession could cost you your job, damage your investments, and downgrade your neighborhood.

And taxes aren’t half of what they’re tinkering with in Washington. Big cuts to federal programs will be part of any tax deal. Will defense industry jobs be lost, teachers’ laid off, your city’s federal funding eliminated?

Furthermore, if the world’s lenders don’t like the way America handles this, will they raise the cost of our prodigious borrowing, and your credit card rate along with it?

Say you calculate your taxes will go up $2,572/yr under some scenario or other, and you conclude “We can live with that.” That’s like saying saying “Only 65 miles per hour winds? We can live with that,” when it’s the tidal surge that’s going to ruin your basement.

We know financial blows are coming, just not from which direction. It makes sense to take steps to put more resilience into your family budget. Take a hit you design yourself, so the one that Congress lands on you is far less painful.