Reason #3 to consume less and save more

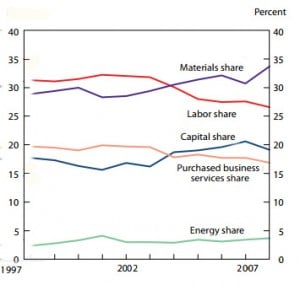

Savings have been outperforming skills.

Can we change the mix in our families over time?

I’m big on the monetary value of higher education and specialist skills. But there is another skill that seems to be paying off even better: the skill of saving money to invest.

“Increasingly, profits have been rising at the expense of workers in general, including workers with the skills that were supposed to lead to success in today’s economy,” says Paul Krugman.

“As best as I can tell, there are two plausible explanations. One is that technology has taken a turn that places labor at a disadvantage; the other is that we’re looking at the effects of a sharp increase in monopoly power. Think of these two stories as emphasizing robots on one side, robber barons on the other.

Whatever the reason, any investments you have are likely doing a lot better than your wages. Money invested in stocks (S&P 500) three years ago is up almost 40%.

Yes, there could be another stock market crash, but the S&P is up over 80% in the last ten years, despite the 2008 crash.

To increase our investment income to better supplement our earned income, most of us have an untapped source of cash to invest: the cash flow that comes from reduced consumption.